Written by Chetan Dogra, CPA

It’s time for IT filing and tax returns again. So pull up your socks and get ready. Now that the 2022 tax season is open, taxpayers should pay attention to the following important information before filing their 2021 tax returns.

What to Keep in Mind for Tax Returns

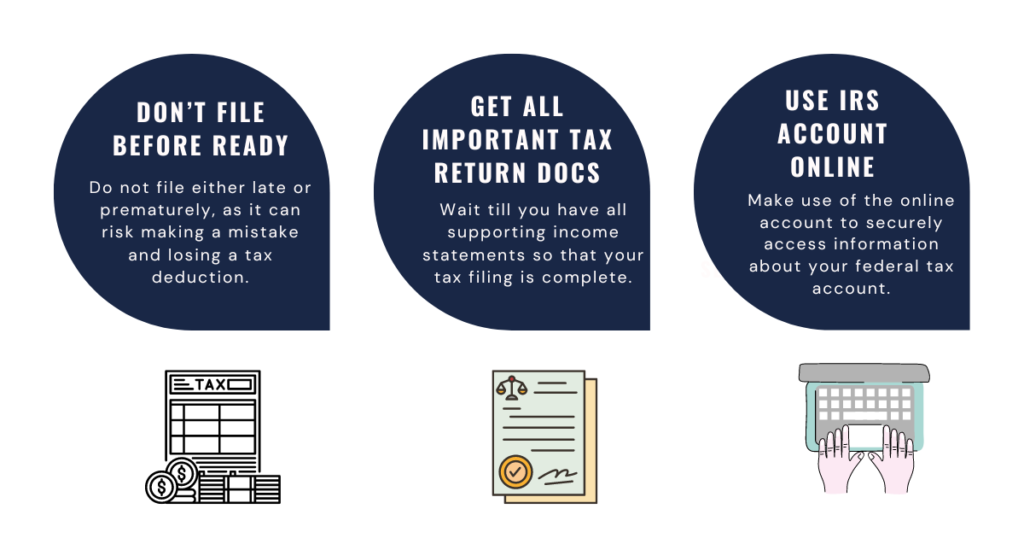

Don’t File Before Ready

Taxpayers should not file late, but also should not file prematurely. Those who file before they have all the required tax reporting documents risk making a mistake that could lead to losing a deduction, credit, or delayed processing due to an error.

Get These Important Tax Return Docs

Taxpayers should wait to file until they have all their supporting income statements, including but not limited to:

- Forms W-2 from employer(s)

- Forms 1099 from banks, issuing agencies and other payers including unemployment compensation, dividends and distributions from a pension, annuity or retirement plan

- Form 1099-K, 1099-Misc, W-2 or other income statement if they worked in the gig economy

- Form 1099-INT if they received interest payments

- Other income documents and records reporting virtual or crypto currency transactions

- Form 1095-A, Health Insurance Marketplace Statement, to reconcile advance Premium Tax Credits for Marketplace coverage

- Letter 6419, 2021 Total advance Child Tax Credit Payments to reconcile advance Child Tax Credit payments

- Letter 6475, 2021 Economic Impact Payment, to determine eligibility to claim the Recovery Rebate Credit.

Use IRS Account Online

Taxpayers can use their IRS Online Account to securely access information about their federal tax accounts, including their estimated tax payments, refunds, total economic impact payments, child tax credit payments and much more.

Why Should You E-File Your Federal Tax Return?

Are you still doing your IT filing on paper? If so, consider e-filing your tax returns. The benefits are plenty. Let’s delve into them deeper.

Complete & Accurate

This is the best way to file a tax return that’s accurate and complete. It’s because the tax software does the entire math for you, in turn, helping you avoid mistakes.

Greater Safety

IRS e-file meets all stringent guidelines and uses the advanced encryption technology. It a reassuring fact that the IRS has safely and securely processed over 1.2 billion e-filed individual tax returns since the beginning of the program.

Faster Tax Refunds

E-filing usually brings a faster refund. The reason is simple. There is nothing to mail and your tax return is less likely to have errors, which take a longer time to process. Did you know that the IRS issues most refunds in less than 21 days? Well, believe it because it’s true! The speediest way to get your refund is to combine online filing with direct deposit into your bank account.

Convenience of Payment Options

If you owe taxes, you can do an online IT filing early and set an automatic payment date on or before April 15, the due date. And the best part is that you can choose your convenient payment option. That’s right. You can pay by debit or credit card, check or money order. If you want, you can even electronically transfer funds from your bank account.

Online IRS Tax Return is Easy

You can e-file your federal tax return through IRS Free File. This is a free tax preparation program that’s available only at the IRS. Alternatively, you can use commercial tax software or request your accountant to e-file your return.

If you qualify for the IRS Volunteer Income Tax Assistance and Tax Counseling for the Elderly, your online IT filing will be done for free.

Why File a Tax Return This Year

Last, individuals who are not required to file a tax return this year are encouraged to do so to claim potentially tax credits such as the recovery rebate credit, child tax credit, earned income tax credit, and others.

Expert CPAs for Your IT Filing

At Dogra CPA LLC, we have experienced CPAs to take care of your tax returns timely and efficiently. Whether you are a business owner or individual and no matter at what stage in life you are positioned, we can help.